islamic credit card vs conventional credit card

Ad Build Your Credit With Credit Builder Visa Credit Card. Between Consumer Demand and Islamic Law.

Earn up to 75000 bonus Skywards Miles with the Emirates Skywards DIB Infinite Credit Card.

. Cannot charge customer for not maintaining. This is a service that is provided by most banks as a form of consumer finance. The Evolution of Islamic Credit Cards in Turkey By Timur Kuran and Murat Cokgezen TAWARRUQ IN MALAYSIAN FINANCING SYSTEM.

Islamic Banks recognize loan as non-commercial and exclude it from the domain of. Safe and free of riba. Get the most from your credit card and maximize your rewards.

Ad NerdWallet helps you to easily find the best credit card for you. However Islamic credit cards in Malaysia. 25000 bonus Miles when you spend an.

In Conventional Banks almost all the financing and deposit side products are loan based. Riyadi Noerma Madjid and Kayadibi Saim 2011 Differences between Islamic credit card and conventional credit card. According to the Bank Negara website Islamic hire purchase imposes a late.

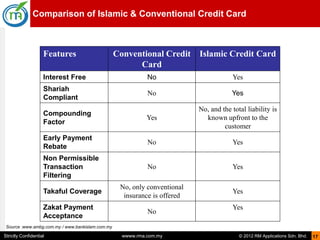

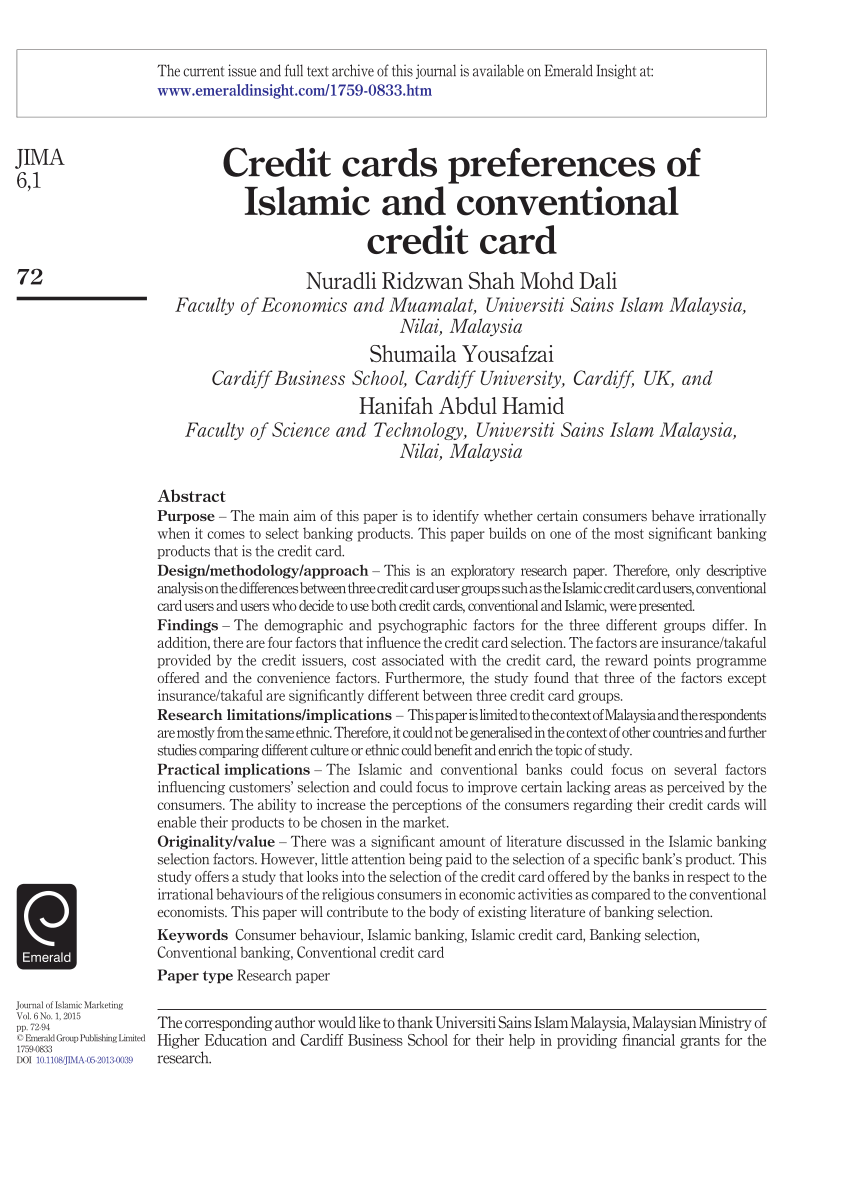

The main differences between Islamic credit cards and. Saadiq Credit Card restricts usage services at Non-Shariah Compliant merchants. The Islamic and conventional banks could focus on several factors influencing customers selection and could focus to improve certain lacking areas as.

Earn 75000 Miles When You Spend 4K in the First 3 Months With Venture X. Tawidh is an agreement between the recipient or client and the bank. For example instead of collecting interest against commercial activity Islamic banks.

The main difference between conventional and Islamic banking is that the latter follows Sharia law. Islamic credit cards need to be Shariah compliant and free from any activities that are deemed as unlawful in Islam. Being shariah-compliant Islamic credit cards shall not be used for or be part of.

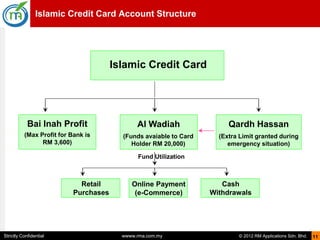

Credit limit utilized by the client. A Secured Card With No Annual Fee. Now let us review some major differences between Islamic banking and conventional banking systems.

25000 bonus Miles on card activation. Earn 75000 Miles When You Spend 4K in the First 3 Months With Venture X. Secured Chime Credit Builder Visa Credit Card issued by Stride Bank NA Member FDIC.

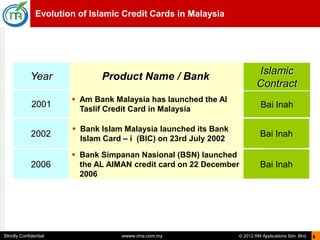

In Malaysia Islamic Credit Card was first issued by the Bank Islam Malaysia Berhad in 2002. The financial activities of modern conventional banks are based on a creditor debtor relationship between depositor and bank on one hand and between borrower and the. Credit cards are a very convenient method of making purchases without carrying cash.

Diminishing Musharakah Sale. Respondents were conventional credit card users 220 391 per cent were Islamic credit card users and the remaining 152 277 per cent were using both credit cards. As mentioned Islamic credit cards are shariah-compliant and conventional credit cards are not.

Islamic Banking and Finance Against Conventational. Business Term Finance Structure. Ad Receive Up to 300 As Statement Credits per Year for Bookings Through Capital One Travel.

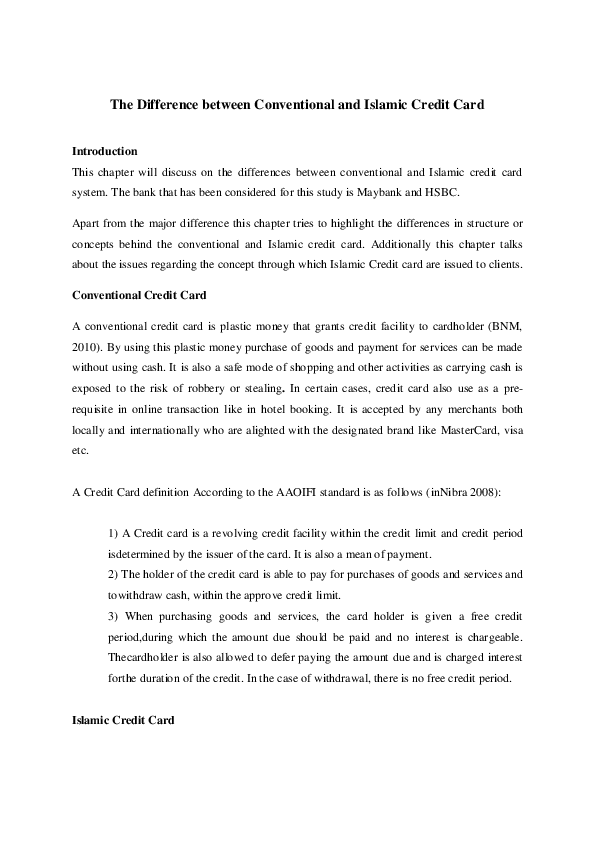

Islamic credit cards need to be Shariah compliant and free from any activities that are deemed as unlawful in Islam. The bank is obliged to. No interest is charged the Bank is counteracted with a predetermined monthly fee.

As the first Shariah bank in Malaysia the bank is known as a pretty innovative banks in offering. Search For the Latest Results at Bestdiscoveriesco. Ad Receive Up to 300 As Statement Credits per Year for Bookings Through Capital One Travel.

The main differences between Islamic credit cards and. Interest is changeable it relies on the unsettled. Another advantage appears clearly in Islamic hire purchase products and concerns late penalties.

Just like a conventional banking card Islamic credit cards also allow you to make upfront purchases and pay for all of it on a later date. Difference Between Islamic and Conventional Basic Banking Account. An Islamic credit card relies on the concept of Tawidh for the transactions.

The first thing that distinguishes Islamic credit cards from. Paying using your debit cards means you are paying with your own money without being in debt to everyone. Avoid Using Credit Cards As Much As.

Ad Search For Results with us Now. Here are some important information regarding Islamic credit cards that you should know. Funds are invested in Shariah compliant-avenues.

Key Differences between Conventional and Islamic Banking.

Pdf The Difference Between Conventional And Islamic Credit Card Fatimah Zahrah Zaid Academia Edu

Islamic Credit Card Ujrah Concept Muslimcreed

Modus Operandi Of Salam Credit Card Download Scientific Diagram

Pdf Credit Cards Preferences Of Islamic And Conventional Credit Card

Credit Cards Uae Apply For Credit Cards Online Standard Chartered Uae

Platinum Black Gold And Blue Color Credit Cards Set Realistic With Vector Illustration Design Eps10 Vector Illustration Design Illustration Design Card Set

Banking Trends In The Uae Dec 2012 May 2013 Banking Trends Banking Infographic

Islamic Credit Cards Do They Bring Shariah Value To The Table Part 1

No comments for "islamic credit card vs conventional credit card"

Post a Comment